DEI shareholder proposals are failing – and not just the bad ones.

Plus Savannah James x Howard University, Verizon's BIG DEI Chop, Costco's Black Supplier Investment, and Home Depot's DEI Cuts

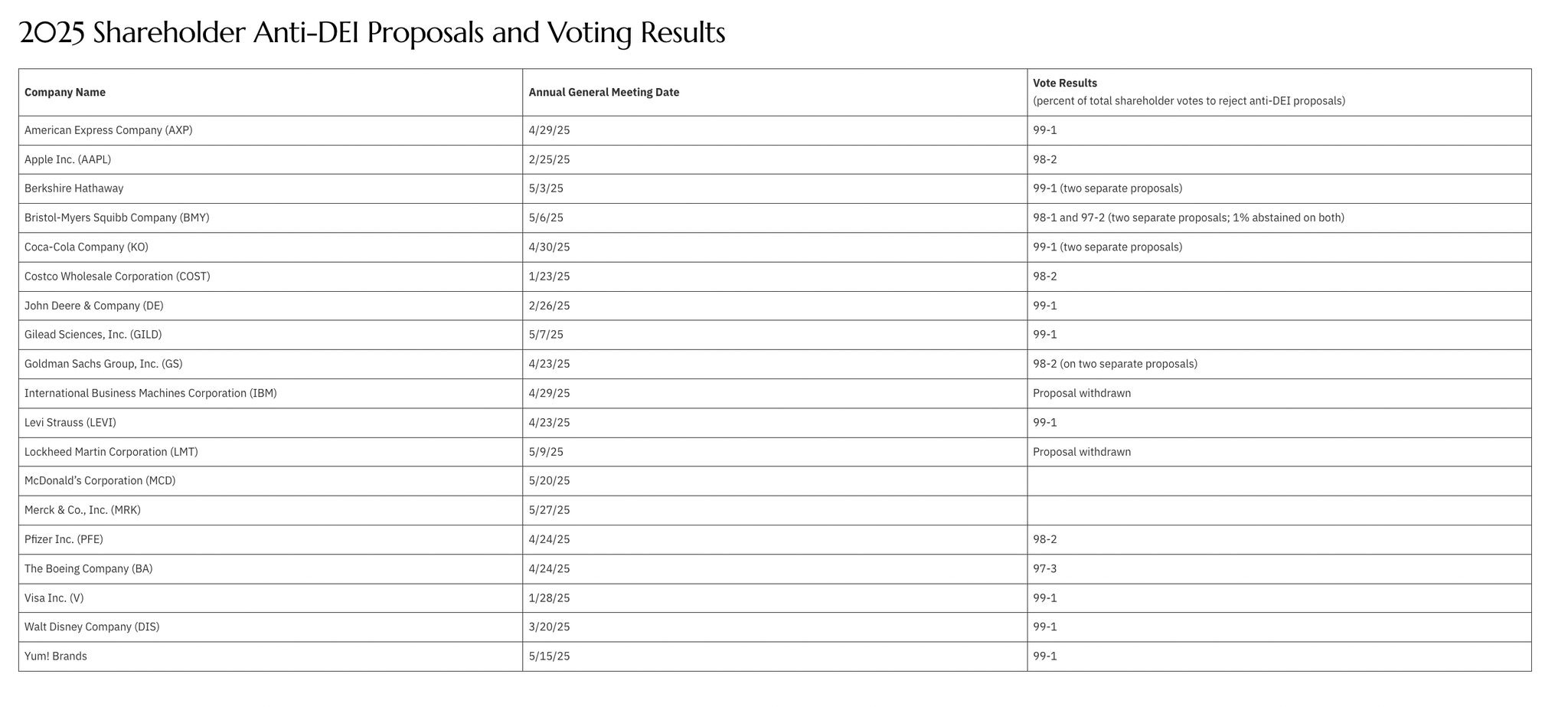

As anti-DEI sentiment rises, a growing number of shareholder proposals are targeting diversity, equity, and inclusion policies inside major corporations.

Do shareholder proposals actually pass? In most cases, no. Shareholder proposals are non-binding—meaning even if they receive majority support, the company isn’t obligated to implement them. And most proposals don’t even reach that level:

In 2023, the average shareholder proposal received about 25–30% support.

In 2024:

Anti-ESG proposals received under 10% support. (Source: Gibson Dunn)

According to a Harvard Law article:

Anti-ESG campaigns grow in numbers but lack support: Proposals countering environmental and social initiatives make up approximately 11% of the total submitted in 2024, but support levels remain in low single digits. These politicized campaigns have failed to make the case for the economic impact related to the requests.

But that doesn’t mean they don’t matter. What we’re witnessing now is shareholders using these proposals as a political tool used more to send a message than to change a policy.

Progressive investors have used them to push for racial equity, climate action, gender diversity, and ethical supply chains.

Now, anti-DEI activists are using the same tactic to stir headlines, apply pressure, and signal to conservative investors that they’re fighting "woke capitalism."

Even when they’re destined to fail, these proposals generate:

Media buzz

Political leverage

Social media narratives

They create the illusion of a corporate divide—even if 99% of shareholders vote against them.

Recently we’ve seen an influx of DEI-related shareholder proposals and the ones that are getting the most buzz are conservative-led anti-DEI proposals. Lots of praise flows in when the headlines hit that the board recommended shareholders vote against the proposal and the shareholders voted overwhelmingly to “keep DEI.”

Here’s a handful from this year alone:

But what we aren’t talking about, are the progressive proposals to SUPPORT DEI, report workforce data publicly, do racial equity audits to assure the company is doing the right thing, and more.

Because while anti-DEI proposals grab headlines, pro-DEI proposals are quietly being shut down too.

Case in point: Berkshire Hathaway.

Shareholders voted on May 3, 2025, and while they did vote AGAINST an anti-DEI proposal, they also voted AGAINST a pro-DEI proposal:

6. SHAREHOLDER PROPOSAL Meredith Benton of Whistle Stop Capital on behalf of Myra K. Young owner of shares of Berkshire Common Stock with a value in excess of $2,000 for at least three years intends to present for action at the meeting the following proposal. WHEREAS: Additional context and background for this request can be found at: https://whistlestop.capital/BRK. Each year since 2021, over one-third of Berkshire’s independent shareholders supported a shareholder resolution asking that it release aggregated promotion, hiring, and retention rate data by gender, race, and ethnicity for its diverse employees. This data is needed to understand the effectiveness of the Berkshire companies’ efforts to ensure meritocratic workplaces. Berkshire has not made this information public, thus investors remain without assurance that diversity, equity, and inclusion (DEI) challenges are being well managed at Berkshire companies. Studies have shown that employees often face discrimination in hiring and promotion as a result of their gender or race.39 Warren Buffett spoke to this at Berkshire’s 2023 annual meeting, stating that “if [I] had been born Black, a woman, or in a different country [I] wouldn’t nearly [have] enjoyed the same type of life [I] have].”

RESOLVED: Shareholders request that Berkshire Hathaway designate a Board Committee to oversee the Company’s diversity and inclusion strategy across its holding companies.

THE BOARD OF DIRECTORS UNANIMOUSLY FAVORS A VOTE AGAINST THE PROPOSAL FOR THE FOLLOWING REASONS: Berkshire’s Board recommends a “no” vote on this proposal. A Board Committee to oversee the Company’s diversity and inclusion strategy is already in place and the Board believes this proposal is unnecessary.

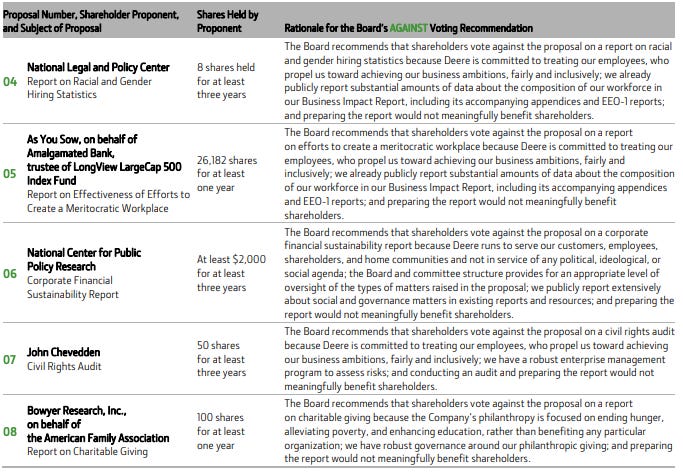

Similarly, John Deere’s shareholders voted back in February, with the board recommending they vote AGAINST all DEI-related proposals, including the following:

The Voting Results:

PROP 4 (Pro-DEI) — REPORT ON RACIAL AND GENDER HIRING STATISTICS — NOT APPROVED

PROP 5 (Pro-DEI) — REPORT ON EFFECTIVENESS OF EFFORTS TO CREATE A MERITOCRATIC WORKPLACE — NOT APPROVED

PROP 6 (Anti-DEI) — CORPORATE FINANCIAL SUSTAINABILITY REPORT — NOT APPROVED

PROP 7 (Pro-DEI) — CIVIL RIGHTS AUDIT — NOT APPROVED

PROP 8 (Anti-DEI) — REPORT ON CHARITABLE GIVING — NOT APPROVED

If the loudest voices are using shareholder proposals to dismantle equity, it’s time for more of us to use the same tools to defend it. Even when these proposals don’t pass, they shape narratives, influence policy, and keep DEI on the corporate agenda.

Here’s how you can get one on the table:

Any individual shareholder can submit one resolution per year to a company—as long as they meet financial and time-based thresholds.

To qualify, shareholders must have held:

$2,000 in stock for 3+ years, or

$15,000 for 2+ years, or

$25,000 for 1+ year

And they must hold onto those shares all the way through the company’s annual general meeting (AGM) to keep their proposal active.

Question: What do you think is more dangerous—companies eliminating DEI outright, or quietly rejecting equity-focused proposals while claiming to “support DEI”?

CULTURE + EQUITY SPOTLIGHT

Savannah James Is Reframing Skincare—And the Equity Behind It

While some brands cut corners to get to market faster, Reframe took the long road—with purpose.

Savannah James’ new skincare line partnered with Howard University’s Department of Dermatology to conduct a rigorous, year-long clinical study—designed for all skin care types. About the Study:

45 participants, ages 26–63

Skin types I–VI on the Fitzpatrick Scale

Double-blind, placebo-controlled, randomized trial

Led by an academic institution known for its commitment to Black health equity

8-Week Results (So Far):

80% saw improved skin hydration with Circadian Cream

70% saw improvement in wrinkles

50% saw improved discoloration with Pigment Processor

Kudos to Savannah and her team — this is what diversity, equity, and inclusion looks like in practice. And it also goes to show that just because a product is Black-owned, Black-founded, Black-led, and/or uses Black partners for mainstream research, marketing, and other services, doesn’t mean it is just for Black people.

"A Black founder can make products that are for everybody," - Tracee Ellis Ross

BDI BRIEF

Verizon Drops DEI to Close $20B Merger

The FCC approved Verizon’s $20B acquisition of Frontier Communication after Verizon agreed to dismantle its DEI programs.

In a letter to the FCC, Verizon confirmed it would:

Remove its DEI website

Strip DEI language from training and internal programs

Eliminate workforce diversity goals

Drop diversity-related executive compensation metrics

Apply the same rollback to Frontier upon completion of the merger

Verizon’s stock rose 1.2% after the announcement.

BLK & Bold Expands to Costco with Midwest Rollout

BLK & Bold®, the first Black-owned nationally distributed coffee brand, launched in Costco on May 19. Its signature Rise & GRND Medium Roast is available in nine Midwest stores across Iowa, South Dakota, and Missouri in exclusive 2 lb bags.

Founded by Pernell Cezar and Rod Johnson, BLK & Bold has built a loyal following through its premium blends and social mission—donating 5% of gross profits to youth-focused nonprofits, totaling over $450,000 to date.

While Costco doesn’t currently report out their Black supplier diversity spends, this launch signals meaningful support for purpose-led, Black-owned brands at a time when many retailers are walking back public equity commitments.

BLK & Bold’s digital-first campaign will support the launch with local engagement, giveaways, and a focus on grassroots connection.

For more information, visit blkandbold.com.

Home Depot Quietly Scrubs DEI Language from Public-Facing Materials

As originally reported by Retail Brew, Home Depot has quietly removed its Diversity, Equity & Inclusion (DEI) webpage, replacing it with a rebranded “WeAreTHD” section that omits all mentions of DEI.

The original page, which positioned DEI as a “competitive advantage,” disappeared sometime after March 28 and is now only accessible via the Internet Archive. While the new content still highlights multicultural employee stories, it no longer names equity or inclusion as corporate values.

ICYMI

The Merit-Based Resumé

With DEI continuing to be scrutinized, we’ve seen more companies lean into language that feels less polarizing and more “middle of the road.” But for one company, we saw them lean into “Merit-Based” as a strategic shield.

Be informed.

Check out the Black Dollar Index Shop for merch that goes towards our mission to create a more equitable relationship between corporations and Black communities.

The Black Dollar Initiative is the indpendent 501(c)(3) research and advocacy hub that supports the Black Dollar Index. Your donation will go towards helping us research, analyze, and report over 120 corporations across 15+ data points. Donations are tax-deductible (EIN: 85-2383485).